RHB Investment Bank (RHB) released its latest update on Malaysia’s banking sector, highlighting robust loan growth, deposit dynamics, and Gross Impaired Loan (GIL) developments.

Overall loan growth remained strong at +5.8% year-on-year, with retail loans leading the charge at +7.9% year-on-year, indicating continued resilience amidst economic fluctuations. Business loans, while showing flat sequential month growth, maintained stability across varying sectors.

May 24 witnessed a significant surge in loan applications, the highest since October 2023, with an approval rate of 50%, underscoring positive liquidity and promising Net Interest Margin (NIM) outlooks.

Deposits saw a +5.0% year-on-year increase, driven primarily by robust growth in Current Account Savings Account (CASA) deposits, which rebounded by +7.4% year-on-year, signalling renewed investor confidence.

The GIL ratio held steady at 1.63%, with mixed performances across sectors. While some segments saw slight deteriorations, improvements were notable in others, such as Personal Financing, Construction, Residential Property, and Credit Cards.

Interest rates remained stable, supporting the sector’s growth momentum amidst prevailing economic uncertainties.

Investors are advised to consider the sector’s fundamental strengths, including strong liquidity, promising loan growth, and attractive dividend yields, amidst recent profit-taking activities that have enhanced sector valuations.

Potential risks include challenges in asset quality, an economic slowdown impacting loan uptake, and increased deposit competition potentially leading to NIM compression.

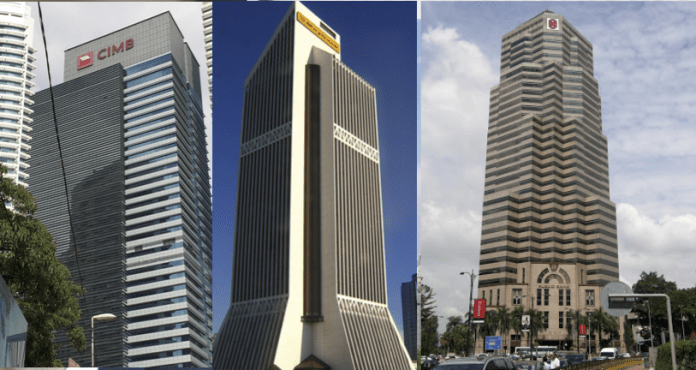

Top recommendations from RHB include Public Bank and HL Bank, backed by strong dividend yields and robust asset quality metrics.